About 20 years ago my mentor and former boss, Richard Creeth, was introduced to a new company called OutlookSoft that had developed a corporate performance management (CPM) product called Everest on top of Microsoft SQL Server and Analysis Services. Richard was well-known back then as an industry analyst and co-author of the OLAP Report and up-and-coming vendors were eager to court his good opinion. Richard was also the principal of a boutique consulting firm that specialized in financial reporting, consolidations and planning which QueBIT acquired in 2008.

OutlookSoft was the first serious CPM vendor to build its solution on top of an existing platform, Microsoft’s. Richard saw this as an important step towards commoditization of the OLAP engine market, envisioning a day when Microsoft’s OLE DB for OLAP (ODBO) standard would allow customers to select CPM solutions and OLAP platforms separately, and enable solution vendors to focus on solving business problems, while platform vendors worked on engineering high-performance OLAP engines for the solutions to run on. Just as an SAP ERP (Enterprise Resource Planning) customer could choose between IBM DB2, Microsoft SQL Server, Oracle or HANA (thanks to the ODBC standard for relational databases) there would come a day when an OutlookSoft customer could choose between (for example) IBM Planning Analytics, Microsoft Analysis Services or Oracle Essbase on the back end.

Ultimately, we thought, it would spur innovation as CPM vendors could focus on what they were good at and leave the complicated back-end engineering to those specialists. Ultimately, we thought, it would be good for customers.

That’s not what happened.

SAP acquired OutlookSoft in 2007 and renamed the product BPC (Business Planning and Consolidation). With a strategy similar to Oracle’s acquisition of Hyperion in the same year (not a coincidence!), SAP then proceeded to take advantage of its existing customer base to grow BPC’s market share. It must have been easy, since every company outgrows spreadsheets and needs a tool for budgeting and forecasting, workforce planning, unified reporting and consolidation, what-if analyses and scenario planning etc.

But by 2017, SAP was pushing a new version of BPC running on its own proprietary HANA database platform, and today, BPC is on the way out altogether. By 2024 BPC will no longer be supported at all, and if you are running BPC on Microsoft (“BPC Standard”), the end-date comes much sooner. If you are running BPC on Microsoft and would like to upgrade to the latest version BPC 11.1 which only runs on HANA – you are signing up for a complete re-implementation, starting from scratch. Your other option if you prefer to stay within the SAP ecosystem, is to rebuild your planning application in the new SAP Analytics Cloud (SAC): a completely new – and unproven – planning software platform.

It’s a good time to shop!

Anyone willing to step outside the SAP world will find there are several exciting new (and old) players in the world of CPM – all with the ability to connect to SAP ERP. Planning software platforms have proliferated with mainstream adoption of cloud-based SaaS (Software-as-a-Service) applications. While the cloud alone does not make technology “better”, “faster” or “easier-to-use”, it does speed up the pace of innovation by removing barriers to entry in terms of capital investment in hardware, data centers and staff.

In contrast, while SAP BPC was certainly a convenient option for SAP ERP customers who needed a budgeting and planning solution (who doesn’t?), BPC inherited certain modeling and performance limitations from OutlookSoft. This explains the move to HANA in 2017, and now the decision to retire BPC altogether. Keep in mind that the technology required to support planning is very different from the technology required to support general ledger accounting (and other functions of an ERP), and there is a reason why companies like SAP and Oracle have historically purchased CPM capabilities rather than developing these capabilities from scratch. It is also worth noting that even though the market for planning software platforms is large and growing, BPC represents only a tiny fraction of SAP’s overall revenues (< 3% by one estimate).

This is a great time to stop and think about your performance management data and analytics strategy. In an age when data is being collected at unprecedented rates and volumes, your data can a tremendous asset, but only if it is used efficiently and effectively. The question you should be asking yourself is: can I afford to stay on my current legacy platform?

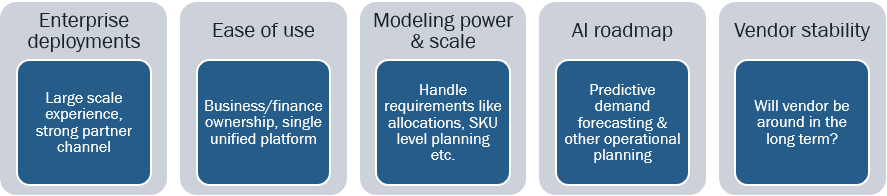

From a CPM software tools point of view, there are many more choices than there used to be. Integrating directly with SAP ERP is done often enough for QueBIT to develop a standard toolset for it. Every vendor has a way to address data integration, but here are the considerations that translate directly into business value:

Have you looked at IBM recently?

While SAP is abandoning its BPC customers, IBM has steadily been investing in its IBM Planning Analytics platform, powered by TM1. As one of the centerpieces of IBM’s Data and AI (artificial intelligence) portfolio, IBM Planning Analytics has benefited from tremendous investment and innovation in recent years, particularly around the user experience and AI-powered predictive analytics. And unlike some of the newer players, IBM is unlikely to be acquired and disappear anytime soon.

You should look at IBM Planning Analytics if any of the following are important to you:

|

A unified platform for financial, operational and integrated planning that can grow over time |

Infusing AI and predictive analytics into your planning processes |

Flexibility to choose between on-premises or cloud deployments, without compromising on features, security, capabilities or performance |

Compelling enterprise reporting and self-service analytics including dashboards, mobile and rich Excel integration |

|

The ability to scale up and support large operational planning models including millions of products and hundreds of thousands of customers (at the same time!), while still being performant |

Powerful business modeling features to support what-if scenario planning including real-time complex calculations (such as allocations, gross margin modeling etc), and fast, configurable scripting |

Secure connectivity to any data sources including SAP ERP (using QueBIT’s Atlas solution), as well as third-party data sources in the cloud (like Salesforce or Netsuite) and legacy on-premises applications |

A vendor that is committed to investing in the technology, and to serving the CPM market for the long run |

Next steps:

- Click here to learn about QueBIT’s 3 – 5 day SAP BPC to IBM Planning Analytics conversion workshop

- Click here to access IBM’s 30-day free trial of IBM Planning Analytics Workspace